Our Focus

We now live in a world of conscious capitalism. The disparity between the rich and poor widens daily. The “perfect storm” is about to descend on us (population growth, food scarcity, shortage of clean water, destruction of the environment, etc.) and the Bottom of the Pyramid will be demanding their fair share of the earth’s resources. To address these developments, social impact investing is gaining acceptance, and providing alternatives traditional market forces.

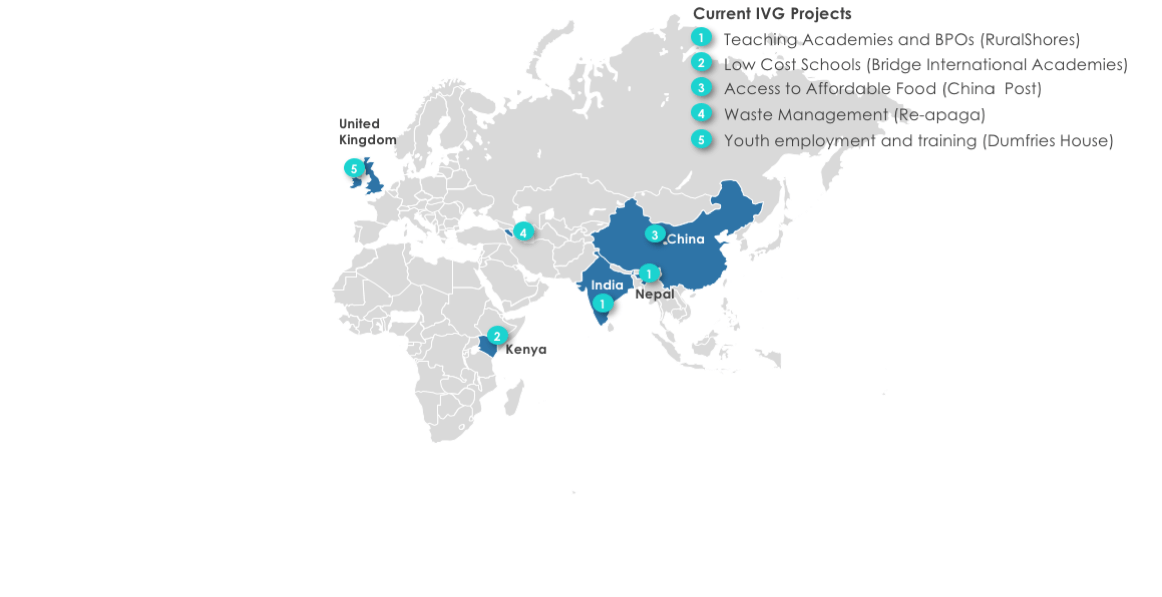

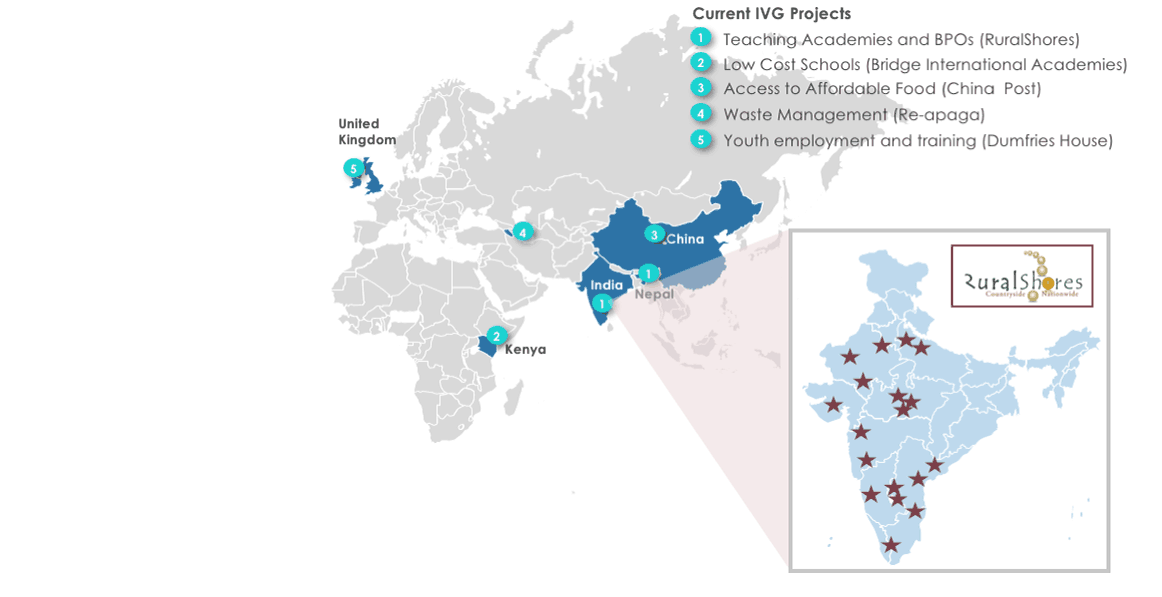

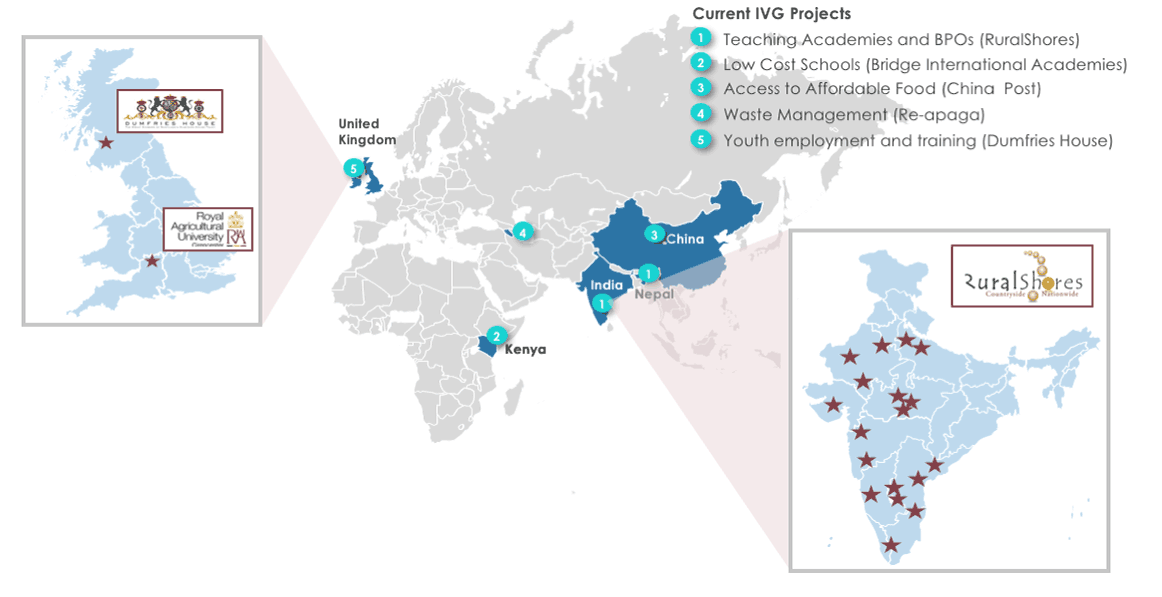

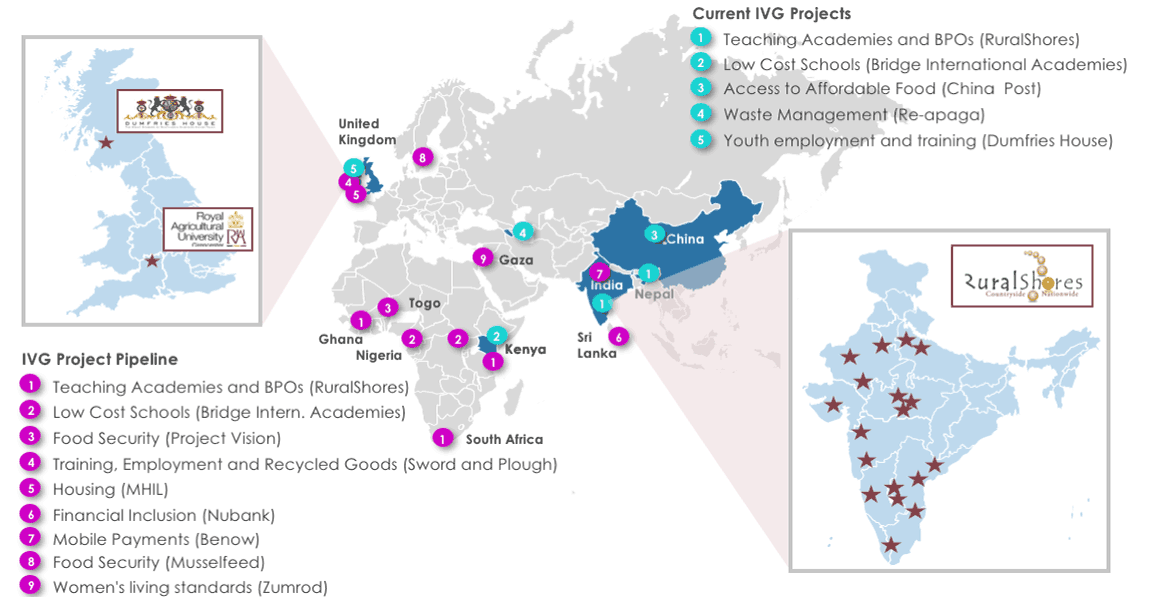

Inclusive Ventures Group (IVG) is an investment platform formed to enable asset owners and managers to participate in the rapidly growing social impact space. An investor club structure, proprietary deal flow network, verticals management and global investment vehicle, with a focus on business model transfer from India to Africa, make up our value proposition. Key activities revolve around fundraising, investment selection and active involvement in managing portfolio companies, including the secondment of employees.

IVG is organized to invest in and manage a nascent but fast growing asset class, to enable investors to participate in a portfolio of global opportunities which generate meaningful financial returns alongside positive social and environmental impact. IVG is a member of GIIN.

IVG key objectives include:

- Invest profitably, but responsibly, in the social impact space;

- Focus on the Triple Bottom Line;

- Identify social and environmental impact that can be empirically measured;

- South-South business model transfers;

- Engage in reverse innovation opportunities;

- Take advantage of Michael Porter’s “Shared Value” approach.

IVG’s Impact Verticals Approach

To enable maximum synergies to be derived, investee companies are managed through verticals as opposed to geographies. Such an approach reduces cost and creates efficiencies, especially where business models are transferred from one market to another. Presently, IVG’s focus is on the following impact verticals:

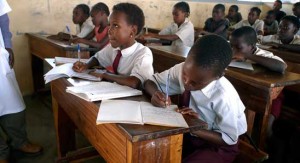

Education & Employment

Investing in businesses that expand the reach of education and provide sustainable employment.

Finance

Expanding the availability of services and finance throughout the developing and developed world.

Food & Water

Investing in sustainable food production, better food transport and storage technology and water purification.

Environment

Promoting new initiatives to preserve or restore the environment, or install environmentally friendly services.

Energy

Promoting and accelerating the production and distribution of alternative energy sources.

Healthcare

Providing a greater range of healthcare services to those currently unable to afford or access them.

Living standards

Investing in technologies and innovative supply chains that deliver cost-effective products and services.

Housing

Providing innovative solutions to building, leasing and buying homes in underdeveloped communities.

Global Opportunities Ahead

To enable maximum synergies to be derived, investee companies are managed through verticals as opposed to geographies. Such an approach reduces cost and creates efficiencies, especially where business models are transferred from one market to another. Presently, IVG’s focus is on the following impact verticals: